On the evening of March 24, 2020, Prime Minister Narendra Modi announced a 21 day lockdown across India. This development was terrifying for all of us, but few people must have felt it as viscerally as Arun K Chittilappilly, Managing Director of Wonderla Holidays Ltd, a South India based operator of amusement parks.

Footfalls in the parks had already started slowing since February on the back of news about the mysterious new virus. It was immediately apparent that parks like his were going to be particularly hard hit. The problem was three-fold:

1. An amusement park is not an essential service in a global pandemic. Even if some semblance of normalcy returned, they would probably be the last to reopen along with movie theatres.

2. The core business model of an amusement park is high upfront investments (Capital Expenditure - on rides and infrastructure) and high fixed costs (Operational Expenditure – Employee and Maintenance costs), offset by high operating margins. But zero visitors still means the rides need to be maintained, and the employees need to be paid.

3. Even if authorities allowed them to eventually reopen, would customers return? In hindsight, revenge spending seems inevitable. But on that March evening, the abyss must have looked particularly dark.

To understand how Wonderla coped, a little background is necessary. The first Wonderla resort came up in 2000 in Kochi, and was called Veegaland. It was an offshoot of V-Guard Industries, a consumer durables brand that got its start with the most Indian of products, the voltage stabiliser. (Voltage stabilisers protect appliances from the vagaries of the power grid.).

The Bangalore park became operational in 2005, and brought all the learnings from Kochi to a larger scale – 39.2 acres against Kochi’s 28.75. The name change and identity refresh too happened around this time. A new park in Hyderabad was commissioned in 2016, and the company was on track to open a new park in Chennai in 2020.

This was a remarkable, if conservative, journey. Amazingly, the company has funded its entire growth through internal accruals, raising very little debt, and paying it off promptly. Contrast this with the very public implosion of Adlabs Imagica, another theme park which opened in 2013 and had amassed debt of ₹1417 crores and had to undergo debt restructuring, a very large and public haircut for its PE investors, and ultimately an exit for its founder.

When Mr. Modi announced the lockdown, Wonderla had more than ₹120 crores in cash and liquid assets (Bank FD’s and liquid mutual funds, largely) on its books. The company had likely built these reserves in preparation for fitting out and opening the Chennai park. This at a time when most companies were guzzling debt, expanding on the base of record low interest rates.

Wonderla’s employee expense for the past year had been ₹40 crores. Theoretically, it could sit out the multi-year pandemic with zero sales. This cushion, however, did not make the company complacent. Employees voluntarily surrendered a major part of their salaries in the tough 20-21 year. The company also set up cloud kitchens to bring in some revenues.

It is no coincidence that Glassdoor reviews of Wonderla are glowing:

“Very good and supportive top management team. Every day there will be a something new to learn. Neat work atmosphere with the employee friendly organization.”

Multiple reviews from 2020 - 2022 mention that salaries are paid on time – in an amusement park, during a pandemic. This is stellar, conscientious leadership, and must be lauded. There were no layoffs to speak of, and the company was rewarded for its patience – sales for Oct-Dec 22 were ₹113.20 crores, up from ₹70 crores during Oct-Dec 19.

The outcome would likely have been very different if Wonderla chose the same path as Imagica – raising institutional money, both venture and debt. Private Equity funds march to the relentless drumbeat of investor expectations, and (consciously or not) atleast some of this pressure gets passed on to portfolio company founders, distorting judgement and priorities.

Imagica, meanwhile, has been taken over by the Malpani group, which already operates amusement parks in Lonavla and Shirdi. Then there is Nicco Park in Kolkata, a joint venture between a private entity and the West Bengal state government. Wonderla has a new park coming up in Odisha in the next couple of years, and is exploring a franchise model to begin its pan India expansion.

It is fascinating to see the ARPU (Average Revenue Per User) inch up every year in Wonderla’s annual reports – an indicator of the growing affluence of its customers. As the market matures and operators expand and eventually compete in some markets, the quality and sophistication of the park experience is bound to go up. Also of interest will be the positioning that the various parks choose – Wonderla’s ticket price averages around ₹1200, while Imagica charges ₹1500 for its amusement park and ₹1000 for its water park. Nicco prices hover around the ₹400 mark.

We would also be remiss to not discuss the 800-pound gorilla in the room – Disney has a 75 year history operating theme parks, and has an annual revenue of $20B per year from parks alone. Naturally, prices are several multiples of anything the Indian offerings cost, and it would be a watershed moment if they chose to open a property in India. With a likely multi-billion dollar investment, Disney would vacuum away the entire top end of the market, while also expanding the market size many-fold in its wake.

Part of the allure of Disney’s theme parks are its Intellectual Property (IP) – Kids around the world know who Mickey Mouse is. With the geyser of cashflow from its theme parks and cable business, Disney acquired some of the best IP created in the last 50 years – Star Wars, Marvel and Pixar, under Bob Iger’s leadership. And of course, it also created some fantastic IP in-house: Frozen, Moana and the like.

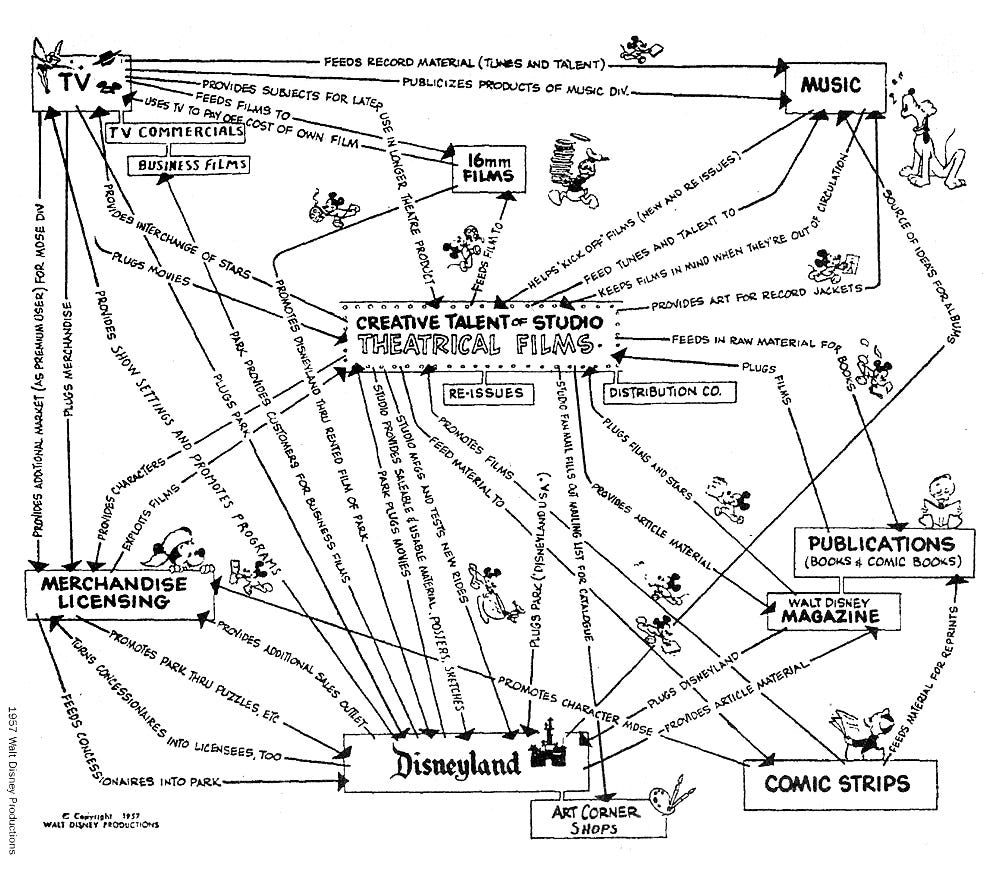

This brings us to Disney’s famous flywheel, where a bunch of complementary businesses feed off of each other and the outcome is larger than the sum of parts. The movies bring name recognition to the parks and merchandise sales. Sometimes rides are made into movies (Pirates of The Caribbean) and Disney+ brings all these characters right into customer homes. All these divisions are in infinite feedback loops with each other and are absurdly profitable.

India’s amusement parks have cracked one part of the code, focusing on a safe, hygienic and family oriented experience. But they are yet to make the transition to storytelling, which ensures the experience remains in customer minds long after they’ve left, and keeps them coming back. So long as operators continue offering a commoditized experience focused on sweating assets instead of building core memories, the Disney threat remains.

Creating IP is a long journey and needs patience and vision to execute. Fortunately, just such a management exists in India. They just need to do away with silly distractions like hosting concerts and focus on building a once-in-a lifetime experience instead of once-a-year outings.

This post is for information purposes only, and should not be interpreted as investing advice. The author may hold positions in the securities discussed.

Excellent read. Thanks for highlighting how an aversion to debt helped them through a tough period. It tends to be under-appreciated in traditional corporate finance that looks to mathematically optimize the capital structure.

Liked it. Can you recall any India amusement park created character? Do you think it is a big opportunity considering the terrible purchasing power we enjoy(?). I am not bullish on amusement park fueled demand for anything mainstream though I am most certainly wrong.